鏈

開發人員

生態系

Staking

Earn BNB and rewards effortlessly

Tokenization Solutions

Get Your Business Into Web3

社群

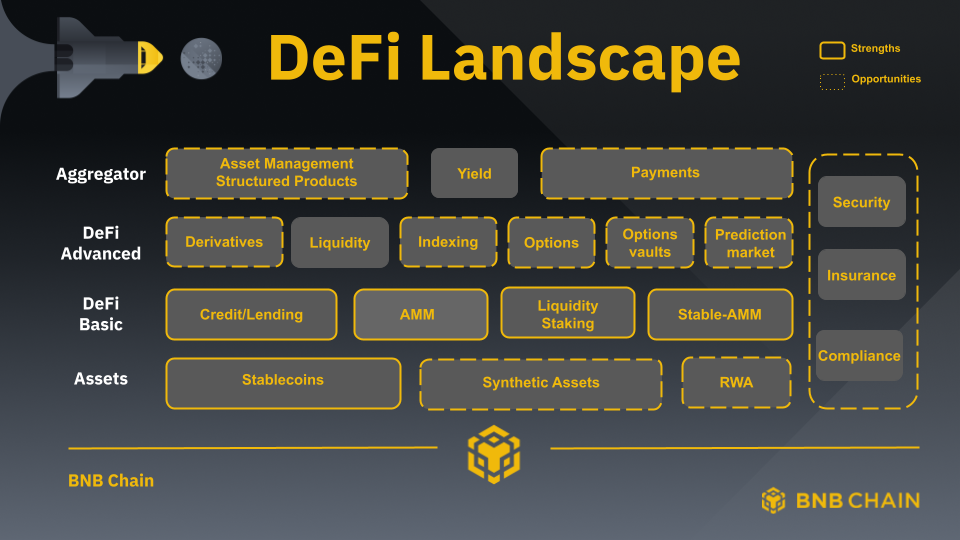

DeFi Landscape: Strengths and Opportunities on BNB Chain

BNB - DeFi Ecosystem Overview:

- BNB Chain is ranked 2nd by TVL, with a significant user base and strong DeFi applications like DEXes and lending/borrowing protocols

- In constructing the BNB ecosystem growth strategy we have identified opportunities for specific categories that can boost the overall DeFi landscape of BNB Chain

- The BUSD stablecoin is identified as the most stable digital asset backed by 96% fiat and 4% treasury bills. BUSD can therefore be further leveraged as a strong foundation for DeFi protocols

- Liquid Staking category is rapidly growing on BNB with projects like Ankr, Stader and pStake.

- There is an immense opportunity to build synthetic and real world assets related applications on BNB

- The other category that offers opportunities to build are Derivative Protocols. Ethereum leads in this category. We seek more projects that bring innovative derivative products to the BNB ecosystem

- Other complimentary projects to build are around ‘Payment solutions’ that can create real disruption and onboard the next million users

- The whole industry is lacking Stress Testing, Risk management, Insurance and reliable security solutions. BNB wants to prioritize these segments. We invite projects from these categories to build on BNB

- Regulation and Compliance have been areas for continuous improvement for BNB. We are actively looking forward to getting more projects from RegTech and other related tools/softwares

Most Valuable Builder (MVB) program will help DeFi projects that contribute to ecosystem needs and bring new innovative ideas to BNB.

Ranked #2 in TVL – Plethora of Opportunities to BUILD

DeFi is not only the largest crypto vertical, but also the one that has experienced the highest level of innovation in the last two years. Using smart contract platforms as a base, DeFi has leveraged blockchain’s technical characteristics to develop a network of interconnected layers which provide decentralized financial services to users. DeFi not only represents the market vertical with the highest valuation, but it is also the one with the highest TVL.

The current TVL across chains stands at around $77bn, of which around $6bn are sitting on the BNB Chain. Nevertheless, in the last few days - perhaps the toughest ones for both the cryptocurrency market as a whole, and for DeFi since March 2020 - the market share of BNB Chain in numerous DeFi sections (dexes, lending, bridge, yield, derivatives, synthetics and staking) has slightly increased. The sum of all this reflects that there are numerous opportunities to build upon BNB for protocols that want to shape narrative around the new generation of DeFi. In this piece we have identified gaps and opportunities in our ecosystem that will be essential to establish BNB as a solid ecosystem with quality and reliable DeFi solutions to build upon.

BUSD the Most Stable Asset, Foundation for CeFi and DeFi

Assets represent the base layer of any economic system, and they also act like that in DeFi. The creation of stablecoins has been perhaps the greatest catalyst for decentralized finance, solving one of the biggest challenges for the cryptocurrency market to develop an efficient economic system: its high volatility. Its introduction has made it possible to have non-volatile account units that are essential for many financial services, such as lending, borrowing, or forecastable interest payments.

Thanks to its partnership with Paxos, Binance has issued one of the most powerful stablecoins in the market with a growing market capitalization of $17.4 billion. BUSD offers a regulated stablecoin that ensures consumer protection (Paxos and BUSD are approved and regulated by the New York State Department of Financial Services), is fully backed by solid assets (96% cash and cash equivalents, 4% US-Treasury Bills) and is audited every month to guarantee the matching supply of BUSD tokens and the underlying U.S. dollars.

DeFi protocols should DeFinitely take advantage of BUSD’s strengths to build on top of it, an asset that offers such a high level of trust and mitigates risk against volatility is the perfect foundation for any decentralized financial product.

Capturing More Opportunities in Synthetic and Real World Assets (RWAs)

Although BNB already has innovative protocols building synthetics and RWAs such as Naos, we are still not where we would like to be in terms of volume or competition. BNB Chain is a bit behind in both categories and needs protocols crafting innovative products around synthetics and RWA because we believe that they are a necessary addition to our dynamic DeFi ecosystem.

Synthetic assets allow users to benefit from fluctuations in the price of an underlying asset without having to own it. They also allow investors to invest in emerging crypto commodity classes that may otherwise be out of their reach due to the structure and characteristics of certain products. Finally, blockchain composability allows these synthetic assets to be used as collateral in various DeFi protocols. Synthetics are a necessary product to offer access and liquidity to investors, with a positive impact on the efficiency of DeFi, therefore also needed in BNB.

Most DeFi protocols leverage crypto assets that must be overcollateralized due to their extremely volatile nature. Real world assets (RWA), being tied assets such as real estate, do not entail this characteristic. RWA can also be understood as a bridge between DeFi and TradFi which could leverage non-highly-volatile assets. RWA’s protocols would help BNB to attract traditional investors, both retail and – above all – institutional.

DEX and Lending - Strong Engines for the DeFi Landscape

The basic DeFi layer allows all the previously mentioned assets to be put to use in two different ways: as collateral to obtain a loan or exchanging them for other assets. Lending protocols capture almost half of DeFi deposits, allowing users to pledge their assets as collateral in exchange for a loan. BNB top lending protocols such as Venus or Alpaca Finance already capture more than $1bn, which gives the chain a 6.14% share among all lending market value (16% if excluding Ethereum). The ability of these protocols to attract TVL guarantees an inflow of liquidity necessary to boost the lending of assets in BNB.

For exchange protocols, we must differentiate between Automated Market Makers (AMM) – which use liquidity pools governed by algorithms instead of an order book system – for volatile and for stable assets. BNB Chain's position on Dexes is already strong with a strong market share and second in volume after Ethereum. This is thanks to protocols such as Pancake, BiSwap, Ellipsis or DODO which had a combined weekly trading volume of ~ $3.5bn and almost 1M weekly active users last week. Stable AMMs use special algorithms that allow the slippage to be smaller, being more capital efficient – a must-have feature for stablecoin trading. BUSD and its growing adoption is the basis for attracting projects that try to optimize slippage, maximize capital utilization and bootstrap large amounts of liquidity. The deep liquidity coming from AMMs, as well as the ability of stableswap protocols to maintain low slippage are crucial to maintain a necessary asset circulation and optionality for the immediately higher layers to function properly.

Untapped Potential in Derivatives

The most advanced DeFi layer includes products that are key in TradFi: derivatives, indexing and options, among others. We also believe that these products are crucial for DeFi, however they still do not generate the traction we would like to have in our chain. We would like to attract more derivatives protocols and also options protocols. The case of Solana in the options market has proven that, thanks to the right protocols, a large part of the market can be taken from Ethereum. Consequently, there is a lot of room to develop new products in the supply of derivatives and options.

Options are among the most used financial instruments, necessary to carry out financial strategies as basic as hedging, and can be very attractive in periods of high volatility. They are essential instruments for institutions, which makes option protocols a fundamental tool to attract them to BNB. Nevertheless, the complexity of options makes them a product that is not widely used by retail users, oblivious to concepts such as the Greeks, at the money or American options. This is why BNB also needs option vault protocols to be able to offer various automated option strategies to meet the needs of the users who prefer to delegate.

BNB is the Third Chain by TVL Allocated to Yield Aggregators

On top of the previously mentioned layers sit the Aggregation Layer. Supply-side protocols aggregate capital into a single protocol and then disperse the capital to various protocols. BNB is already the third chain with the most weight (~ 9.8%) in yield aggregators, close to the 9.9% held by Fantom but still far away from the 67% of Ethereum’s market share across chains. Although BNB already has a strong position in this category, new protocols could help us compete even more with Ethereum.

Payments - the Window for DeFi to Power World’s Economy

One of the priorities of the BNB aggregation layer are protocols that develop effective payment solutions. A considerable part of BNB Chain users come from historically underbanked countries, which complicates payment services, for example, it is not possible for millions of individuals to have a credit card. Hence, BNB Chain can be the door for millions of users to benefit from secure, decentralized payment services deployed on the blockchain that do not discriminate against any user.

In order to reach the masses, there's a need for crypto payment gateways so that e-commerce could really be powered by different crypto assets. BNB needs protocols that bring these assets into a position where they compete head-to-head with current fiat current systems, and BUSD offers the perfect vehicle to build on. Any protocol that focuses its work around the development of payment solutions will be more than welcomed in our chain.

Path Towards Trustless DeFi Infrastructure: Security, Compliance & Insurance

All these layers share a clear need: high security. According to the level of maturity and the latest events, we can expect that the scrutiny of crypto is going to be more and more present. It is essential to increase the security of the protocols deployed in our chain. Not only to have healthy mechanisms and protocols but even more importantly, to avoid any systematic risk that spreads throughout the chain, as has happened with projects known to all. To lure back DeFi expansion in current circumstances, investors and users must feel safe. This can only be achieved through protocols that directly address risk and security.

A combination of protocols focused on risk management, compliance and insurance are necessary to provide a framework of trust. Although BNB already has interesting protocols in this field, there are still many functionalities missing beyond contract audit. Mechanisms that mitigate rugpull or other dishonest participants’ behavior are required, and while BNB can help a lot in this regard, protocols that specifically address these issues will also be needed. Insurance, together with stress testing projects, are a priority for BNB Chain to differentiate ourselves as a secure chain that offers trust to its users, and according to the current market share of our chain, there is a lot of potential to develop leading protocols. An integration of projects that addresses these challenges will not only help BNB circumnavigate these uncertain times, but also to establish a foundation on which to build a new DeFi paradigm. This paradigm will certainly require an extra layer of security, risk mitigation and trust.

Conclusion

BNB is already the chain with the largest number of users among any other L1, with a zero downtime and with tx fees and tx finality (e.g., max 4 blocks reorganizations compared to over 150 in Polygon). On top of that, the chain has a rich diversity of assets, laying down a very competitive base for any protocol that wants to build with us. The DeFi landscape in BNB is also quite strong (besides RWA, also one of our priorities) in the bottom two layers, assets and DeFi Basic. Great liquidity in the AMM, stableswap, lending as well as an essential piece for our DeFi ecosystem such as BUSD make up the necessary foundation to scale up the upper layers, where we still find some gaps. Our priorities in these top layers are in various types of derivatives, indexing, prediction markets and payment solutions. BNB also prioritizes security, insurance and compliance protocols which are essential for the entire landscape presented here.

We have tried to give an overview of the current situation of the DeFi landscape in BNB Chain, especially showing the gaps that exist in our ecosystem and where we believe the greatest opportunities lie for protocols that want to help us reshape our DeFi landscape by strengthening its efficiency. BNB is one of the leading L1’s and we believe that it can serve as a great base layer to develop decentralized finance protocols. To help protocols building innovative solutions achieve their goals and ours, BNB Chain and Binance Labs run the Most Valuable Builder program, focused on helping projects develop and grow more organically through coaching, investment, and network support.

Rafael.BNB